Hey there! So, you’re trying to get your finances in order, huh?

Trust me, I get it—managing money can be super overwhelming, especially if you’re just starting out.

But don’t worry, I’ve got you covered with some simple and practical tips to help you budget like a pro. Let’s dive in!

1. Figure out your financial goals

First things first, you gotta know what you’re working towards. Are you saving for a vacation? Trying to pay off student loans? Maybe you just want to build an emergency fund.

Whatever it is, having clear goals will help you stay motivated. Write them down and keep them somewhere visible, like on your phone or your fridge.

And don’t be afraid to dream big—your budget should reflect your aspirations!

2. Track every single expense

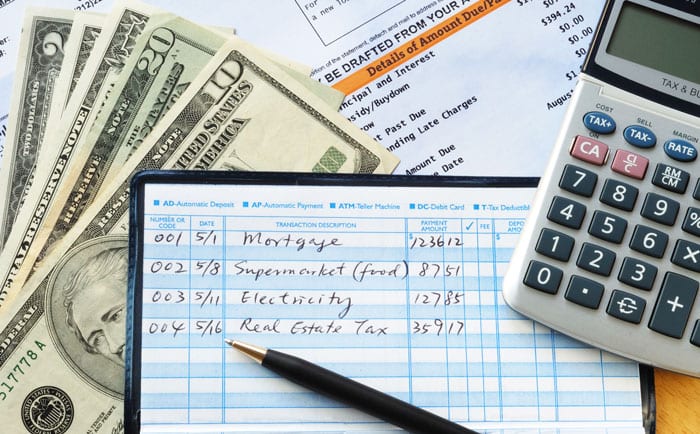

I know, it sounds tedious, but tracking your expenses is a game-changer.

You might be shocked to see how much those little purchases add up. Use an app like Mint or even just a simple spreadsheet to record everything you spend for a month.

This will give you a clear picture of where your money is going and where you can cut back.

3. Create a realistic budget

Now that you know where your money is going, it’s time to create a budget. Break it down into categories like housing, groceries, entertainment, and savings.

Be honest with yourself—if you love eating out, allocate enough money for it.

The key is to make a budget that you can actually stick to, not one that looks perfect on paper but is impossible to follow.

4. Automate your savings

This one is a lifesaver. Set up automatic transfers to your savings account so you don’t even have to think about it.

Treat your savings like any other bill that needs to be paid.

Start small if you have to—even $20 a week adds up over time. If you get a raise or a bonus, increase your savings rate.

You’ll be surprised how quickly your savings can grow without much effort.

5. Review and adjust regularly

Life changes, and so should your budget. Make it a habit to review your budget at least once a month.

Did you spend more on groceries than expected? Did you get an unexpected bonus? Adjust your budget accordingly.

This flexibility will help you stay on track without feeling too restricted.

Creating and sticking to a budget might seem daunting at first, but with these tips, you’ll be well on your way to financial success.

Remember, it’s all about finding what works best for you and staying committed to your goals.

You’ve got this!

For more detailed guides, check out Bank of America’s Better Money Habits, CNBC Select, and Investopedia.

Happy budgeting! 💸✨